Loan Recovery System (SOWin) is designed for large banks and loan funds. It allows you to automate both the soft (amicable) recovery process consisting in the monitoring of the debtor, as well as the hard (judicial) recovery.

The program allows the collection of data on creditors, securities, control of the debt level and repayment, flow of information and documents at every stage of recovery.

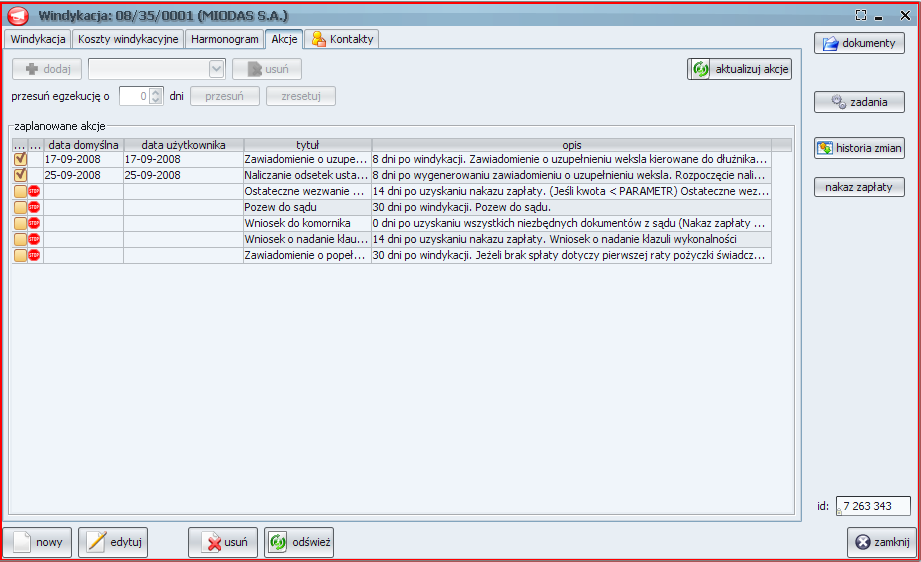

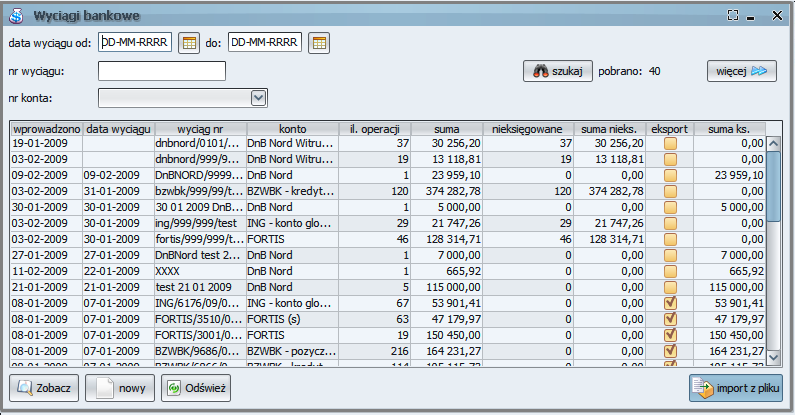

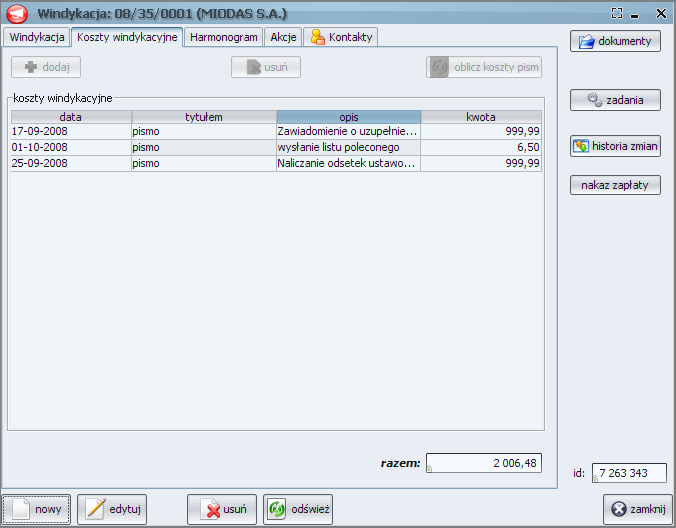

The system records financial information about the principal that is paid and recovered, and calculates the statutory or contractual interest. The records concerning the amounts and timing of debt repayment can be either taken directly from the banking system or recorded manually. SOWin is equipped with bookmarks for the supervision of the judicial and enforcement proceedings related to the recovery of debts. It allows you to record information related to the above proceedings from the date of filing, through defining the feasibility time limit, to handling the debt collection process. Additionally, the program has a mechanism to automatically generate the pleadings for the chosen period. The documents are generated based on built-in templates and filled with the data from its own database. Loan Recovery System allows you to automate all the repetitive and mandatory activities, allows to create specific conduct procedures (steps) to be completed by the designated employees. The process of generating the notification is performed automatically based on the predefined administrative settings. SOWin contains a module to record all the contacts with creditors and other parties involved in the proceedings (bailiffs, securities, etc.). The application allows you to collect, share and archive various documents produced within the collection activities or attach externally. The register of recovery costs allows to record the costs incurred in carrying out the procedure for recovery from the respective creditors. The registry courts and bailiffs allow you to create directories with the contact details of individual institutions participating in the collection proceedings.

Summary of features:

- Records of financial transactions and payment control

- Supervision of court and enforcement proceedings

- Support of models of conduct (workflow) and tasks

- Contact history

- Register of debt collection costs

- Registry of courts and bailiffs

- Cooperation with the Call Centre module

- Generation and control of document flow

- Reporting

- Data exchange with the banking system

- Export of data to financial – accounting systems