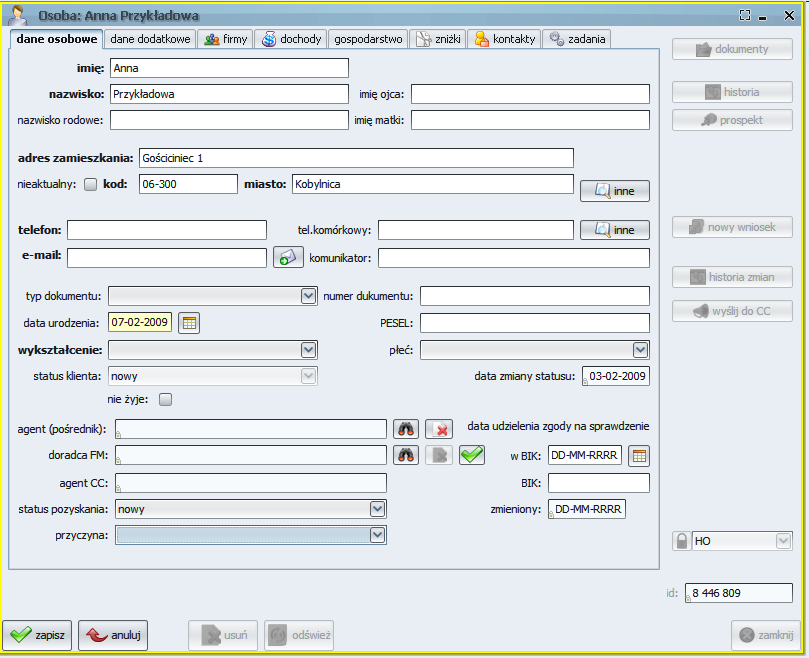

Loan System is a product designed for loan funds which provide loans or guarantees from their own funds or EU funds (financial products available in the JEREMIE initiative, loans from the PARP resources). This allows you to automate the process of lending, from assessing the creditworthiness of the customer, through the selection of the product, the process of concluding and inspecting the loan, to managing the process of loan recovery.

The program provides a collection of data about borrowers and securities, security, control of repayments and debts, the flow of information and documents at every stage of the loan.

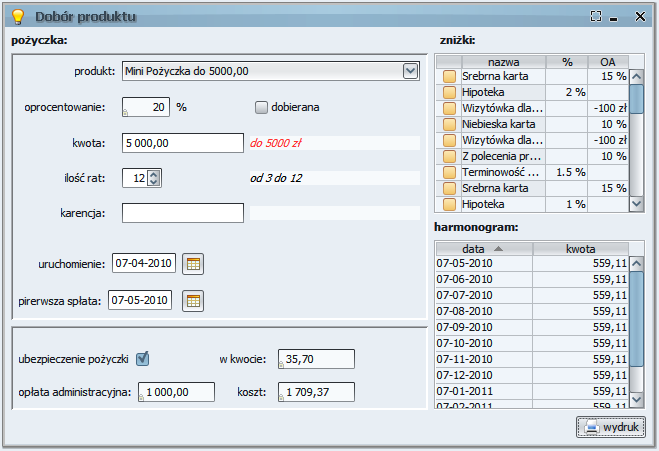

Loan System contains loan product catalogues. The directory contents can be defined individually by specifying the parameters of the loan, such as:

- size of the interest rate,

- sum of commission fees,

- method of calculating instalments (fixed / descending instalments)

- reduction in interest rates and commission charge

- number of instalments, grace period, etc.

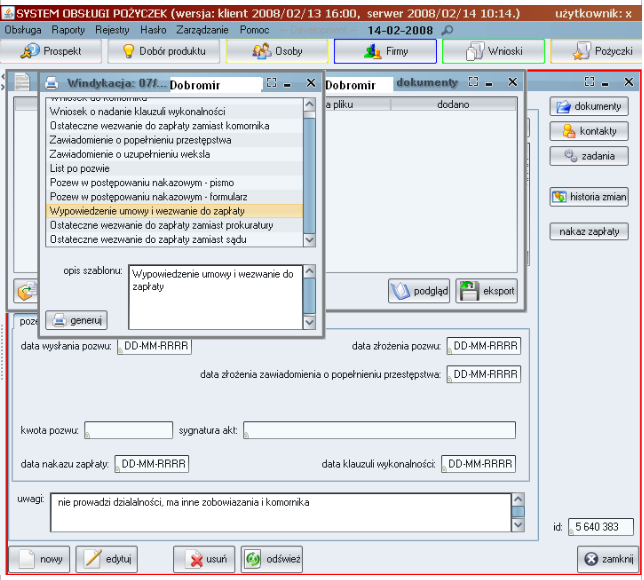

The application has an option to automatically start borrowing from a bank account. It allows you to generate a series of documents associated with each stage of work in the program. The documents can be generated based on predefined templates – these include: requests for loans, contracts, payment plans, reports on the loan, request for payment, the documents relating to the recovery of the debt, and many others. The program also allows the attachment of text and image files from outside the system.

SOP ensures interoperability with bank systems. You can get bank statements in the following formats: Minibank, MT940, SIMP, DnB and others. It will automatically load the data on payments made by customers to the bank accounts and identify the recipient of repayment and the assignment of the loan agreement.

The system has a tool to export data to financial and accounting systems, the data can be exported in the analytical or synthetic system. The procedure allows for quick recording of all the financial transactions and eliminates the need for multiple processing.

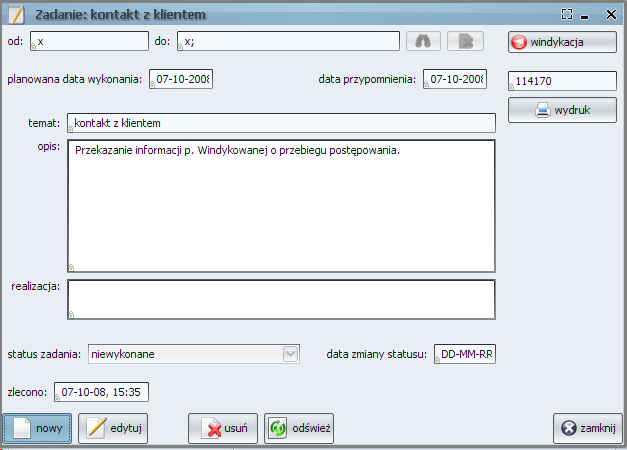

The system contains a task module, whose main objective is to transfer and delegate work between users. The tasks can also be automatically generated based on individual models of conduct. The task module accelerates the processing of applications and increases the efficiency by controlling the timing of actions.

Loan System includes a module for managing the collection process at all stages, from the so-called soft (amicable) recovery consisting in the monitoring of the debtor to hard (judicial) recovery. The module allows you to control the level of debt and repayment, the flow of information and documents at all stages of recovery.

SOP also has a Call Centre module, which allows you to schedule your marketing campaign – a tool to support the process of acquiring a customer.